Section 179 Deduction Vehicle List 2024 Irs

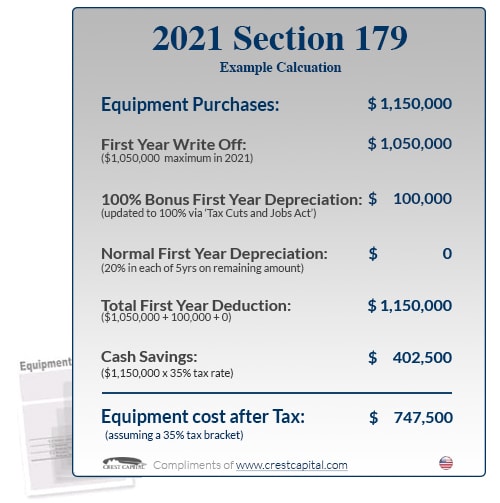

Section 179 Deduction Vehicle List 2024 Irs – Tax Code 179, the special deduction a vehicle from qualifying, so do your homework! IMPORTANT: This is the list of 2023 models that qualify, however, in 99% of the cases, the 2024 models . If you happened to purchase the vehicle in a prior year and want to claim the Section 179 deduction, unfortunately, that is not permissible. To qualify for the deduction in any given tax year .

Section 179 Deduction Vehicle List 2024 Irs

Source : www.joerizzamaserati.com

Section 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.com

Section 179 Tax Benefits | Woltz & Wind Ford

Source : www.woltzwindford.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Tax Deduction for 2023 | Section179Org

Source : www.section179.org

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Deduction Vehicle List 2023 Mercedes Benz of

Source : www.mercedesoflittleton.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

BEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : www.youtube.com

Section 179 Tax Exemption | Land Rover Anaheim Hills

Source : www.landroveranaheimhills.com

Section 179 Deduction Vehicle List 2024 Irs Maserati Section 179 Deduction for Vehicles | Joe Rizza Maserati: Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . The inflation-adjusted elements will apply to the 2024 tax year, meaning returns filed in 2025. The standard deduction We’ve added you to our mailing list. .