2024 Irs Schedule C

2024 Irs Schedule C – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

2024 Irs Schedule C

Source : carta.com

Budgets 2 Goals | Baton Rouge LA

Source : www.facebook.com

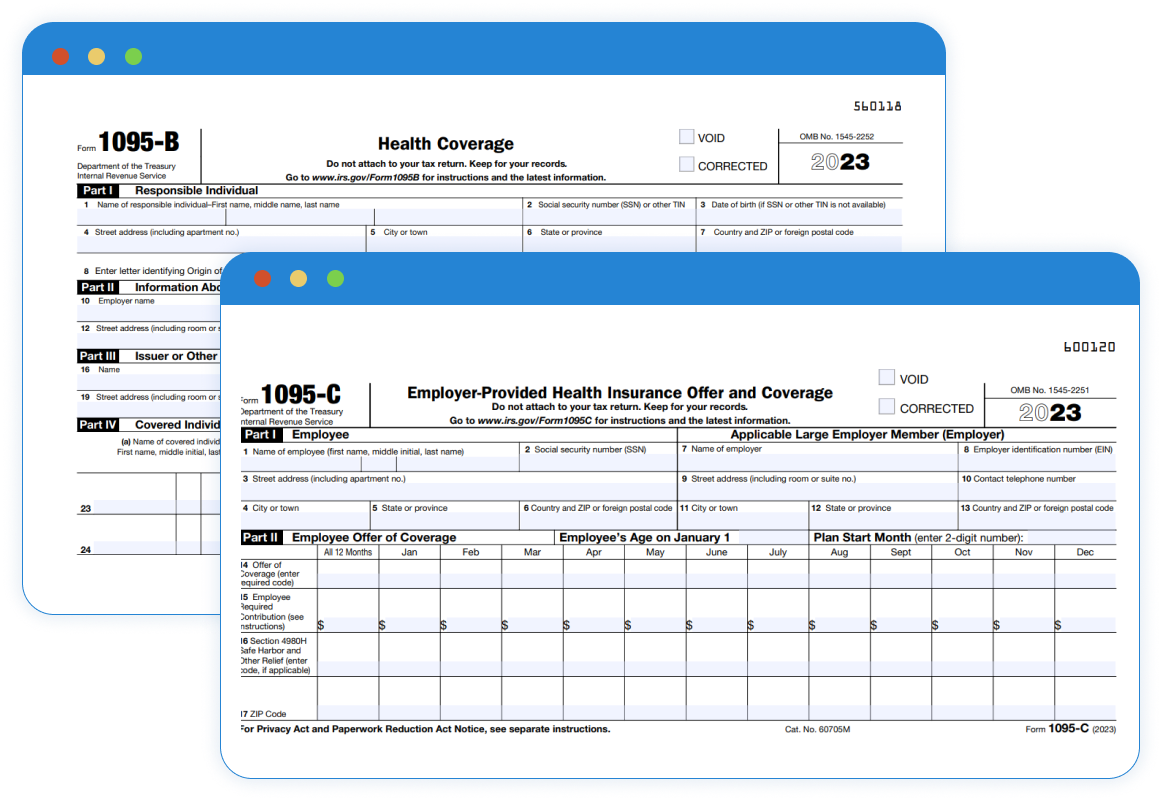

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

Safe Harbor Bookkeeping DFW

Source : www.facebook.com

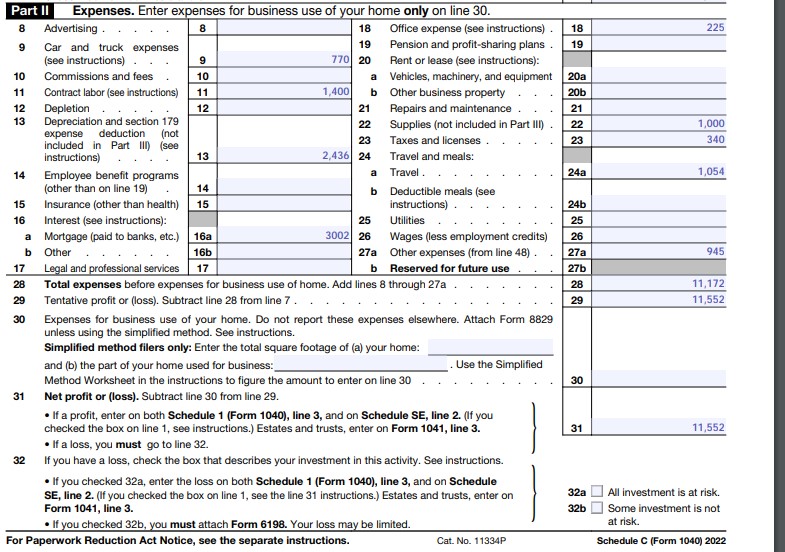

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

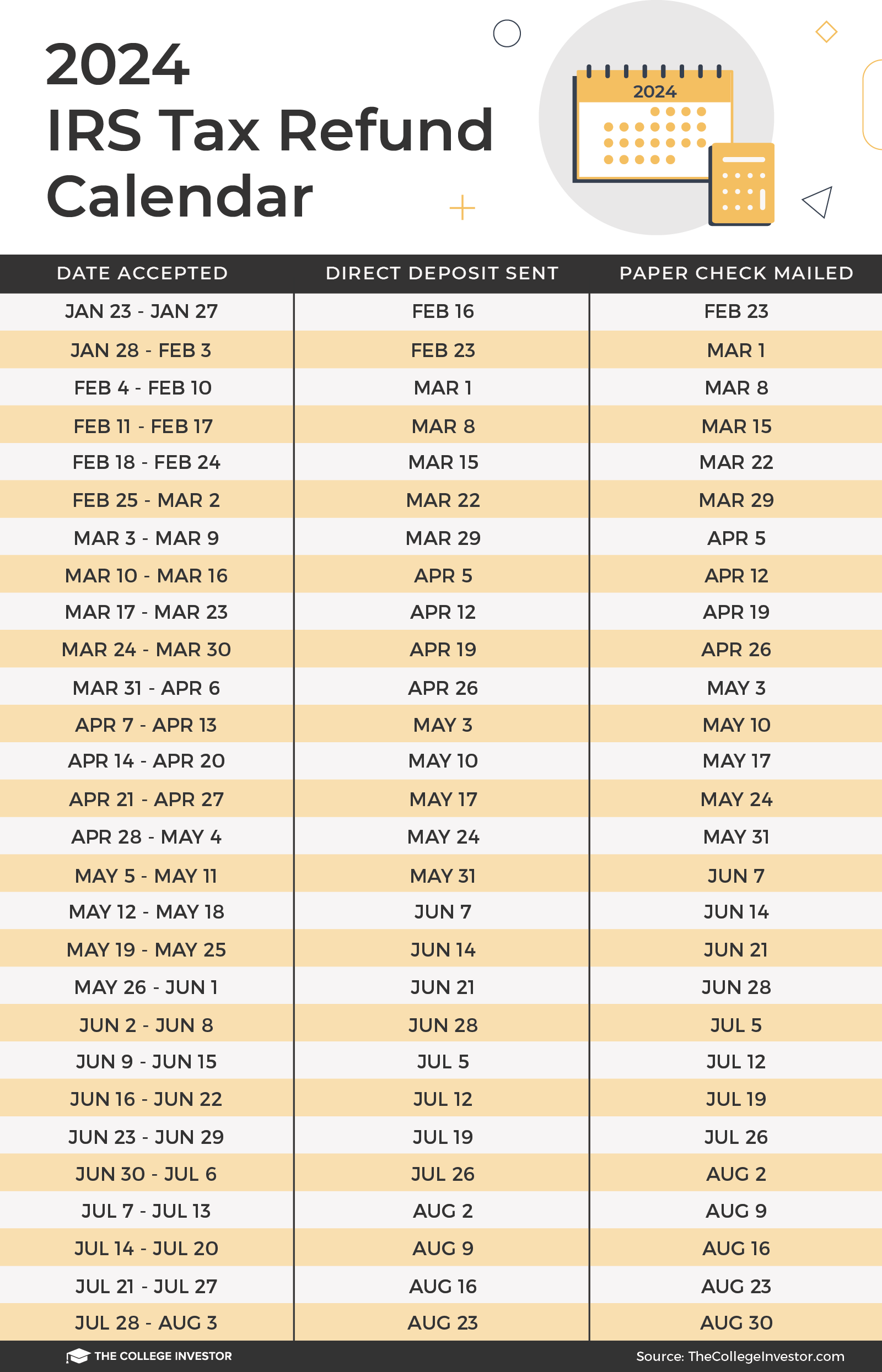

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

M & J Services | La Villa TX

Source : www.facebook.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

IRS to Require Electronic Filing for ACA Reporting in 2024

Source : www.newfront.com

Here’s who qualifies for IRS’ free ‘Direct File’ pilot program in 2024

Source : www.cnbc.com

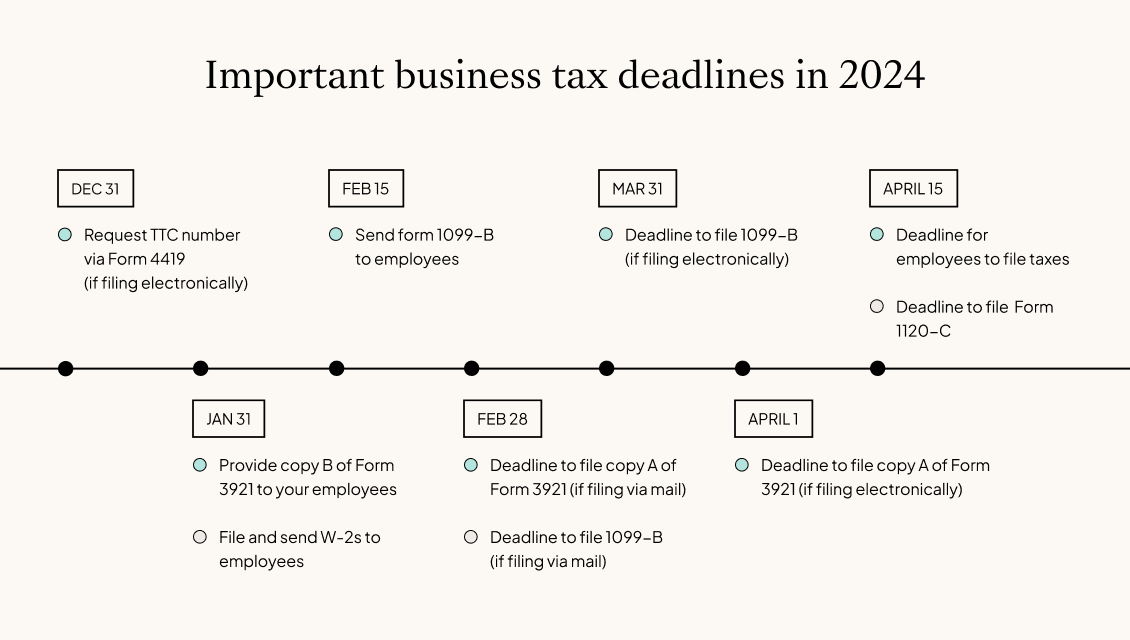

2024 Irs Schedule C Business tax deadlines 2024: Corporations and LLCs | Carta: Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . The recent announcement by the IRS regarding the adjustment of income limits within the seven tax brackets for 2024 brings about critical changes in the taxation landscape. These modifications, .